How to Budget for Big Expenses Like Property Taxes

When we sit down and talk to Spend users, they always tell us, “my finances are a little wonky right now.” For example, I just sat down with someone recently to talk about how he uses Spend, and he mentioned that he stopped using it because a multi-thousand-dollar property tax bill landed last week and totally threw him off his budget.

Spend has four ways to stay on budget when a big expenses happen.

- Recovery (recommended): spread out the cost over time

- Transfer from savings: cover all or some of the costs by consciously bringing in additional cash from savings

- Goals: when you can anticipate these big expenses in the future

- Ignore: pretend the expense didn’t happen and hope for the best

It’s important to know how and when to use these tools to stay on budget.

Recovery

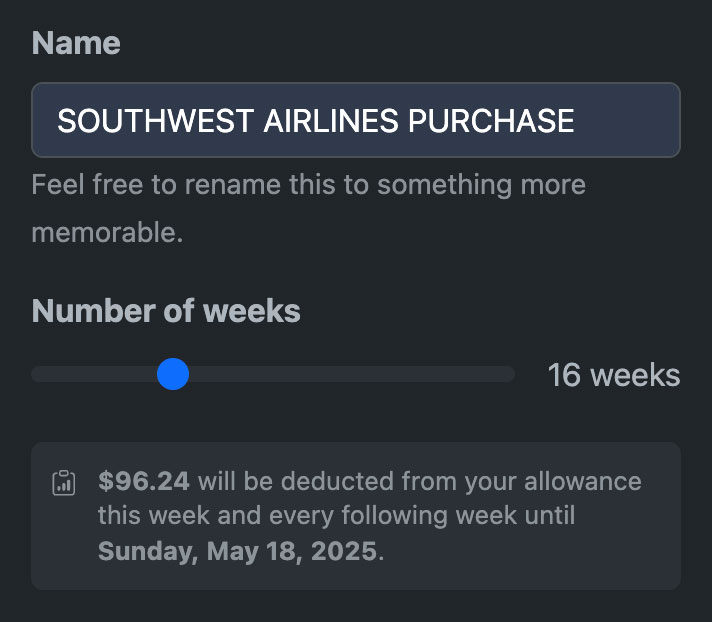

When I have a large unexpected expense, one of my favorite options is to create a Recovery. I can click on the expense’s dropdown, choose Recovery, and decide how long I want to take to pay myself back. It’s like spreading the cost of the purchase over multiple weeks instead of it hitting all at once.

I recently needed to buy emergency plane tickets for a family trip. I didn’t have anywhere near the amount to cover the price of five plane tickets to Texas in my Safe to Spend. I opted to recover the cost, reducing my allowance by $96.24 for the next 16 weeks.

Recovery also works great for large discretionary purchases too, like Black Friday sales.

Transfer from Savings

By design, Spend only tracks your spending accounts—checking, credit cards, and depository accounts. We don’t track your savings accounts. This means that when you transfer money to your savings account, Spend treats the transfer like an expense.

The reverse is also true. You can transfer money into your checking to recover from big expenses.

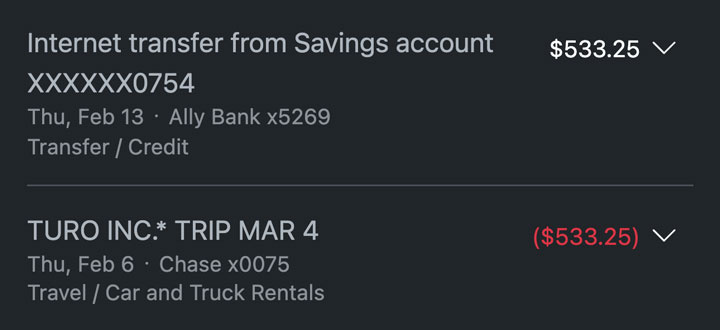

You can see here I booked a rental car on Turo for $533.25 and then transferred $533.25 from my savings account to offset the cost.

Goals

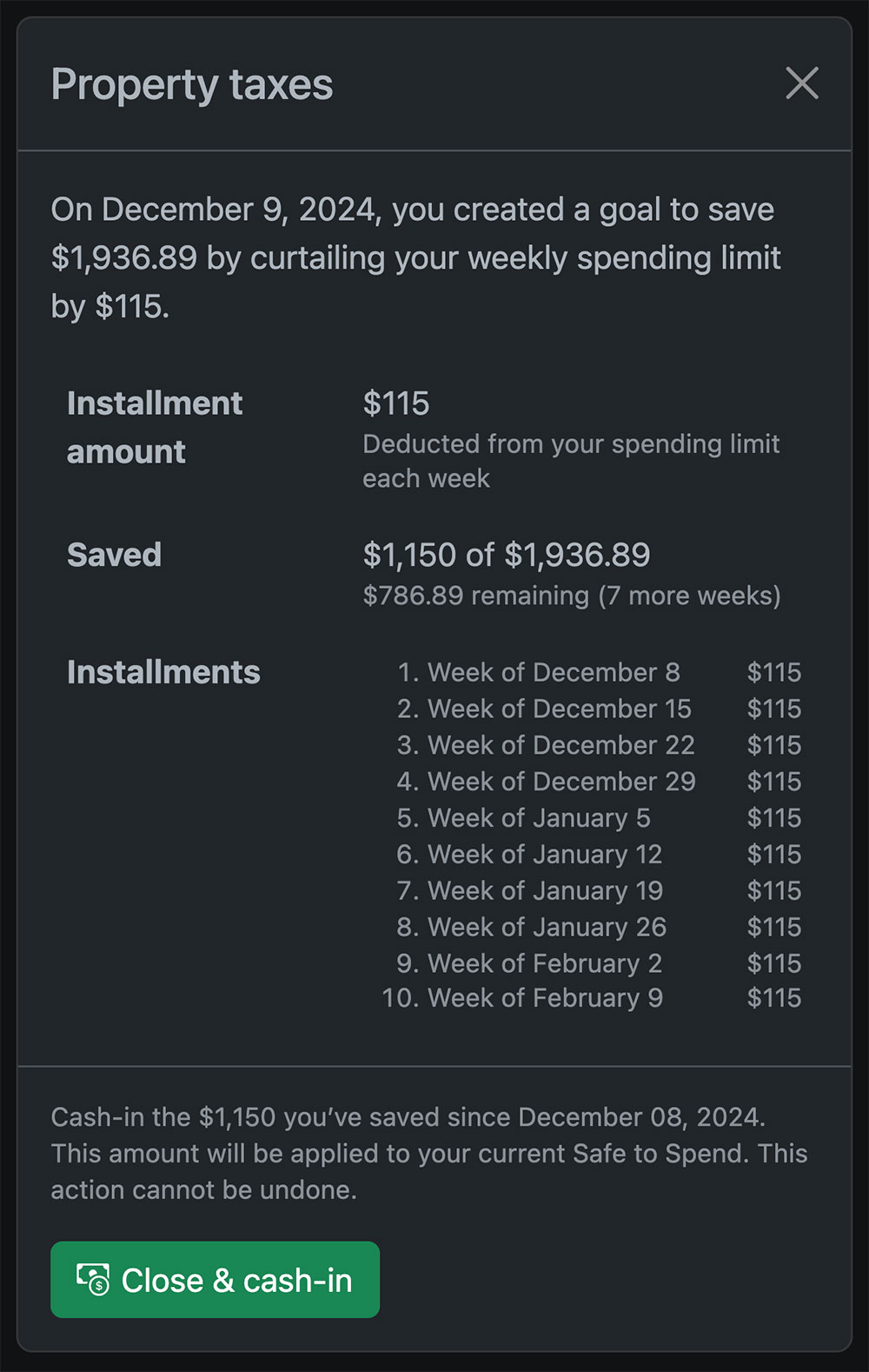

If you know an expense is coming, you can set money aside every week to help cover the cost. Spend lets you create a Goal on the Plans page. This is how I handle my own property taxes.

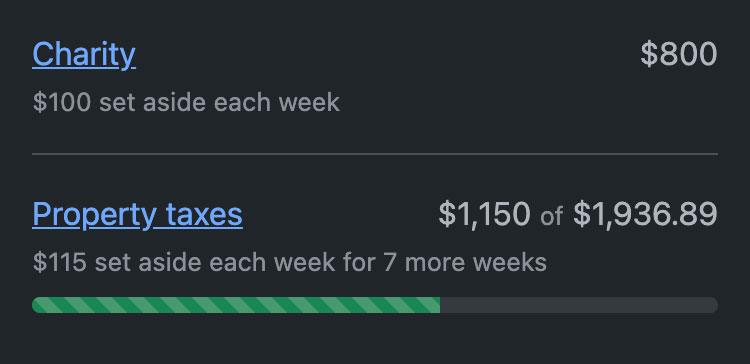

You can see here that I’ve already created two goals. The first is a Charity Goal that sets aside $100 every week forever. The second is a Property Tax Goal that sets aside $115 every week until I have $1,936.89, which is how much I’ll owe in April.

When April rolls around and the $1,936.89 bill comes due, I can “Close & cash in” my Goal and the entire cost of the taxes will be offset. Similarly, whenever I am feeling charitable, I can cash in my charity goal to offset those expenditures too.

Ignore

Spend also lets you ignore a transaction. Let’s say you have $600 left in your Safe to Spend and $5,000 in your checking. If a $1,000 expense comes in, your Safe to Spend is going to be overspent by $400. Without recovering or bringing in additional income this week, this deficit will also carry over to the following week.

In certain situations, it can be OK to simply ignore the transaction. In the above example, ignoring the transaction will leave your Safe to Spend at $600. But your checking account balance will go down by $1,000 leaving you with $4,000 left. Recovering a transaction is preferred to ignoring because eventually you’ll have $5,000 in your checking account again.

Written by Morgan, co-founder