Safe to Spend: The Only Number You Need

Spend helps you stay on budget by providing you with a single, glanceable number that updates as you spend. We call this Safe to Spend and it finally takes the guesswork out of answering the question, “Can I afford it?” In this post, we explain why Safe to Spend is key to budgeting, spending with certainty, and ultimately achieving financial independence.

The Power of Now

Mint was great for tracking how you spent over time. It was easy to know exactly how much you spent in any category last month. If I needed to know how much I spent on transportation or coffee shops in the last month, it was a click away on Mint. Of course, it was only accurate if you took the time to ensure everything was categorized, which is a whole other discussion.

The real problem came when I wanted to know how much I could spend on something today. Mint had no tools for this kind of proactive budgeting. They trusted that with enough information and your own spreadsheet, you could figure out whether you could afford something.

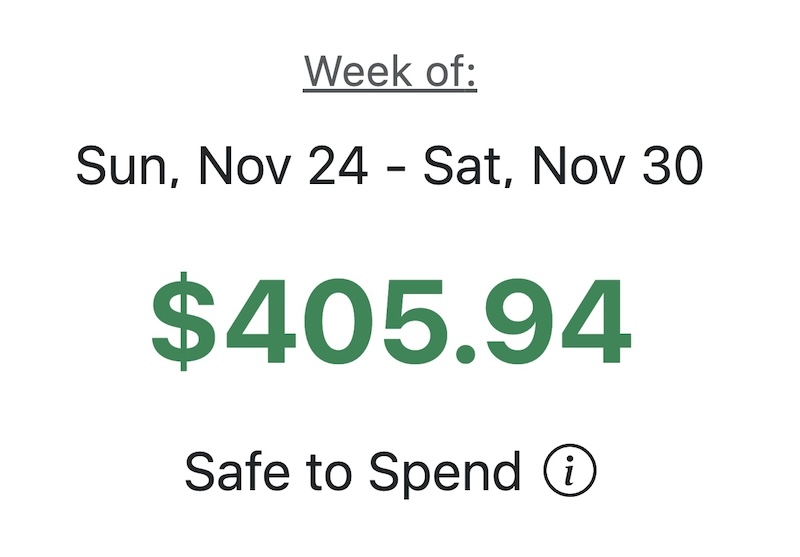

Safe to Spend does just that. Each week (or month if you prefer), Spend determines how much you can afford to spend on discretionary expenses and updates it in near-real-time as you spend throughout the week.

Categories Don’t Work 🙅🏽♂️

Some apps use categories or ask you to account for every dollar that’s spent. You set aside $150 for gas, $300 for food, etc. This setup time seems like a fair trade and certainly caters to those of us out there that have some version of OCD and want everything to have a home.

Unfortunately, it’s not sustainable. Accounting for every dollar means constantly updating the system. For example, if you worked from home last week you’ll spend less on commuting. Now, that category is underspent, while a different category, say groceries in this example, is over-spent. It takes a lot of work to know whether you’re truly overspent or if you’re just needing to move money from one place to another. The rigid system doesn’t match the flexible world.

It even looks rigid:

From Hello Sensible: Ynab vs Mint – Which Is the Best Budgeting App?

Most weeks are special in some way—if we had a nickel for every time someone told us, “My finances are a little wonky at the moment.” Keeping your budget accurate, means tweaking it every week to keep everything balanced. After a while, that work becomes tedious, your budget falls out of true, and you stop using it.

Spend is different: it doesn’t worry about the category you spent on, it worries about how much you’ve spent overall.

Single-Number Superpower in Your Pocket 🦸🏻♀️

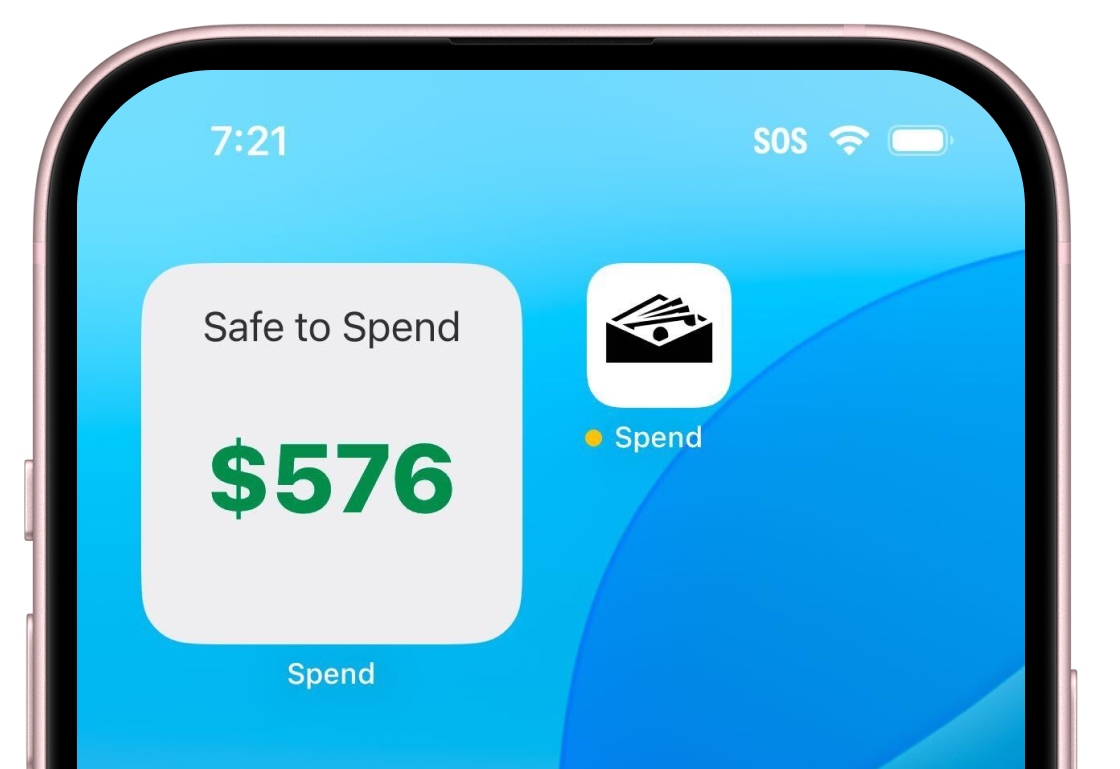

Safe to Spend is the first thing you see when you open Spend. Plus, our mobile apps have a widget that sits on your home screen, showing your Safe to Spend at a glance. Not only that, but because it’s on your home screen, it’s easy to keep top-of-mind.

The beta version of our iOS Safe to Spend widget

Every time you unlock your phone, you’ll know how much you have left to spend for the week. Spend it on groceries, communiting, or avocado toast—it doesn’t matter, and it’s no additional work. Soon staying on budget becomes as familiar as the weather, your agenda, or your activity tracker.

Weekly > Monthly

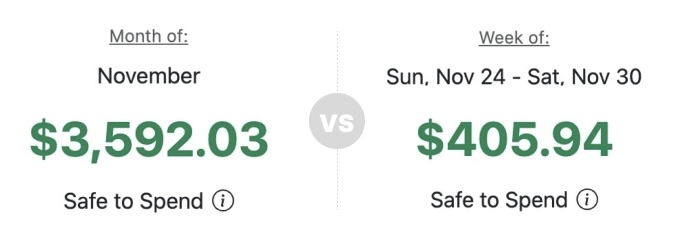

Spend defaults to a weekly view, the sweet spot to keep track of what’s happening.

If you use your checking account balance as a budget tracker, then pay day makes it feel like there’s plenty of money to spend. It’s easy to think you can afford all of your bills and still go out to dinner. Spend breaks up that paycheck into a weekly amount, so it’s easier to track how much I have to spend now.

Monthly balance feels way too high, weekly balance feels just right

In a weekly view, it’s easier to correct mistakes and get back on track too.

Lastly, while bills happen monthly, a lot of the things happen about once a week. Groceries, gas, the farmer’s market, and Taco Tuesday all happen about once a week, and it’s easy to remember to save for them once instead of planning for the whole month.

Spend with Certainty

Safe to Spend is the most useful feature of Spend. If you don’t spend more than you have, your net worth can only increase. Because Safe to Spend tracks all of your spending across all of your accounts and ensures that you don’t overspend, tracking Safe to Spend is the easiest, most important way to stay on budget.

Written by Morgan, co-founder