Black Friday, Red Budget: How to Take Advantage of Deals and Stay on Track

With Black Friday looming on every website, social media post, and physical letter in your mailbox, the pressure and urge to spend is higher than ever. With Spend’s goal to help you spend with certainty, we’d like to talk about one of the most useful features of Spend when your budget gets “weird.”

There’s a lot of ways that the unexpected affects our finances. This time of year, there are some amazing deals. You already planned to spend on something, and now it’s available at a steep discount. Maybe you’ve been saving, maybe not, but if you don’t buy it right now, you’ll end up spending more.

It happens to all of us. We feel like we’re just getting on top of our finances and something happens—a popped tire, a broken appliance, a sick pet, Black Friday.

When this happens it can be expensive. When you’re stuck with a bill, or you want to buy something that’s more than you can afford in a week, there’s often no choice but to dig into your savings or pretend your budget is fine when you know it’s not.

Because we experience this, too, we built Recovery as a really powerful tool in your financial toolbox.

What’s a Spend Recovery?

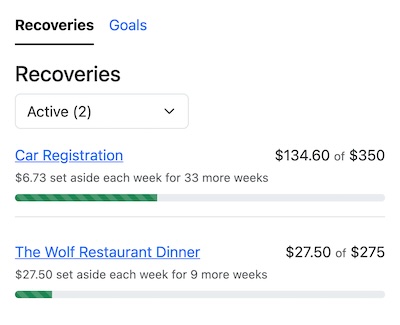

Large transactions can throw off your Safe to Spend and make your budget less useful. When you’ve overspent, you can click the “Recover” option in the transaction dropdown and spread out that cost over time. You decide how many weeks it’ll take to pay yourself back and Spend does the rest. The more you set aside each week, the fewer weeks your Safe to Spend will be affected.

Isn’t This What Savings is For?

If you have the time to plan for an expense, savings are a great way to prevent the expected from ruining your budget. Spend lets you create goals that set aside money every week towards a future expense.

The power of saving isn’t in being able to buy what you want, it’s in making your money work for you by investing it. You want your savings to keep growing. That’s the key to financial independence. If your savings gets big enough, you can pay off your car, or buy a house and eliminate your rent.

If you stop thinking about your savings as money you expect to spend, and instead think of it like an emergency fund that you keep full, you’ll be closer to investing.

Recovery allows you to get back to where you were before the unexpected happened and to keep your savings growing instead of being spent.

What About Alternatives?

Spend’s Recovery is very similar to some of the other products like Affirm, Afterpay, and Klarna. For a fee, these companies do the work for you, automatically charging you for your previous payments. Credit cards also let you make large purchases and then you can decide when to pay them back.

Both credit cards and buy now, pay later (BNPL) rely on your forgetfulness in order to take your money. Credit cards would prefer that you maintain a balance to earn interest, BNPL would like you to forget that you will have to pay them. Spend brings these concepts front-and-center, ensuring that you not only remember that you have to set aside that money, but doing it for you.

Your Safe to Spend takes your Recovery into account, ensuring that as long as you track your Safe to Spend, you’ll eventually pay yourself back for your recovered expenses. It’s like an interest-free loan against your future spending.

View all your recovered transactions

Stay on Budget, Despite the Unexpected

No other budgeting software provides you with a way to deal with unexpected spending as a part of your budget. Knowing that I have this incredibly powerful tool that lets me stay on budget, deal with what life throws at me, and recover from unexpected expenses makes me feel more certain in my spending.

We hope Recovery is useful to you as well.

Written by Morgan, co-founder