Why a Budget is the Most Important Financial Tool

When we decided to build Spend, we had to decide which part of a person’s finances to focus on—what part of their financial journey to streamline, to simplify, to make obvious. There are a lot of tools around personal finance—and we’ve reviewed many of them—but nothing fills the need that we have.

What we want out of a personal finance tool is to know that we won’t wake up one day unable to pay our bills or be surprised that we’ve come up short. We want to be able to spend freely, knowing that the future is guaranteed.

And believe it or not, a solid budget is the key ingredient to make that happen.

Having a budget that provides the right information at the right time is the most transformative financial tool I’ve ever experienced.

Here’s a simplified example of the power of a budget. It starts with the basics of how much do you make and where does it go, looking at the biggest line items first.

First of all, let’s assume I’ve got $5,000 in my checking account, plus some monthly income and expenses I can count on every month:

- Starting balance: $5,000

- Monthly salary: $4,000/mo

- Rent: $2,000/mo

- Other bills: $1,000/mo

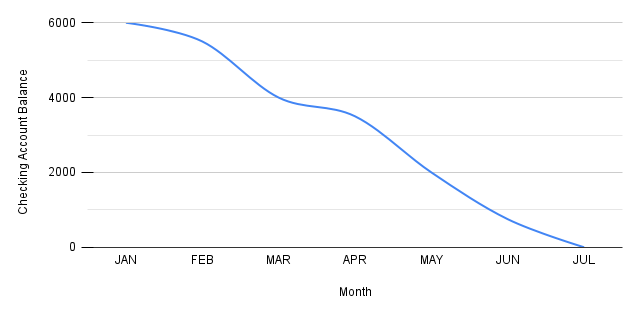

The month begins, I get paid my salary, I pay my rent and bills, and I have $6,000 left in my checking account. I think to myself, “as long as I don’t spend $6,000 I’ll be able to afford all my bills next month—that’s pretty good!” I start the month feeling great that I don’t have to worry about money, so I go out to eat, I go out with friends, and before I know it, I’ve spent $2,000 on entertainment, food, and drink, leaving me with $4,000 left in my checking account. But I’m about to get paid, so all good! Right?

Like before, the next month begins, I get paid my salary, I pay my rent and bills, but instead of $6,000, I have $5,000 for the month. I still feel good, but you see where this is going:

Looking at how much cash in my checking account is a bad way to decide if I can afford something. Without a budget, I’d slowly run out of money and eventually come up short. Not good. I want the opposite. I want to be adding to my money.

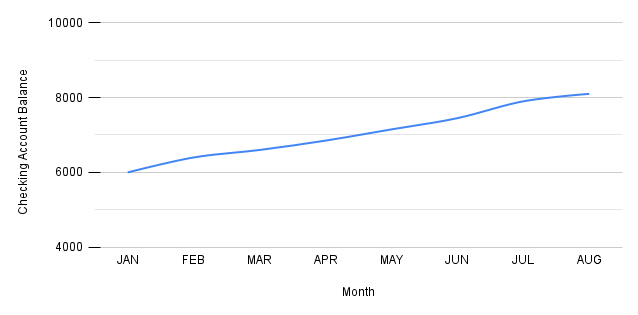

Instead of tracking how much I can spend by looking at how much I have, I instead look at how much I have left: my income ($4,000) minus my recurring expenses ($3,000) = $1,000. If I never spend more than I make, I can never run out of money. I start the month with $1,000 as my spending limit (instead of $6,000) and now I know I can afford my lifestyle. Spend takes this a step further and tracks my money weekly. Spend says I have about $250 this week to cover everything including gas, food, clothes, etc. When I looked at my cash balance, I felt good, but now I can see that $250/week is not actually that much.

The most important thing a budget can give me is understanding of my financial situation.

Now that I know how much I can spend, what can I do to improve it? Less avocado toast and lattes can only do so much. One of my monthly bills is a $300 car payment. If I paid off my car, would that allow me to save? Another $300 a month might make a difference. Could I sell some old equipment or furniture that’s taking up space or take that bonus and put it towards paying off the car? Because once I pay off my car, now there’s $300/mo (or $75/week) that can go towards my lifestyle, savings, or a new goal. If I choose to save it, now, my monthly cash balance is going up!

One of the reasons that a budget is so transformative is that once I understood how much I could spend, and once I understood how much I wanted to spend, then I could figure out how much I could save.

There’s so much more that financial planning and information can give you once you have a solid, understandable budget, which we’ll cover in future posts, but it’s the first thing you’ll need. That’s why we built Spend and why we use it every day.