Stop Categorizing Expenses, It Doesn’t Work

Almost all the popular personal finance apps out there, encourage you to categorize every transaction. These are apps like EveryDollar, Goodbudget, Lunch Money, Monarch, Wally, and YNAB. They follow in Mint’s footsteps but now that Mint is shutting down, it’s a good time to ask yourself categorizing your spending is worth the time.

At Spend, we think your time could be better spent and our customer’s tend to agree.

I have found watching fluctuations in some categories to be interesting, but that hasn’t motivated a lot of real, meaningful change. — Mandy, Leadership Coach

Where Do Categories Come From?

Every bank transaction has some detail associated with it:

Transaction Amount: The amount of money involved in the transaction, either as an inflow (e.g., income) or an outflow (e.g., expenses).

Date and Time: The date and time when the transaction occurred. This information is important for tracking the timing of financial activities. While all transactions will have a date, only a few (10-20%) will have time precision.

Description or Memo: A short text description or memo field that provides additional information about the transaction. It may include details such as the payee or the purpose of the transaction. Often these descriptions are incredibly hard to parse. Amazon and Venmo are notorious for providing very little information to go on to help customer’s pair the transaction to a purchase or transfer.

Transaction Type: Indicates whether the transaction is a debit (money going out) or a credit (money coming in).

Account Information: The source and destination accounts involved in the transaction, such as a bank account, credit card, or loan account.

Merchant or Payee Name: The name of the business or individual involved in the transaction. This can help identify where the money was spent or received.

Notice that category is not provided. Because of this, personal finance apps have developed some ways to categorize transactions:

Educated guessing: Each app does this a bit differently. In some cases, this can mean using external data sets to enrich the transaction metadata. In other cases, this can be building Machine Learning models that are trained using categorized transaction data sets. But ultimately, it’s just a guess and, as you’ve probably experience, is often inaccurate.

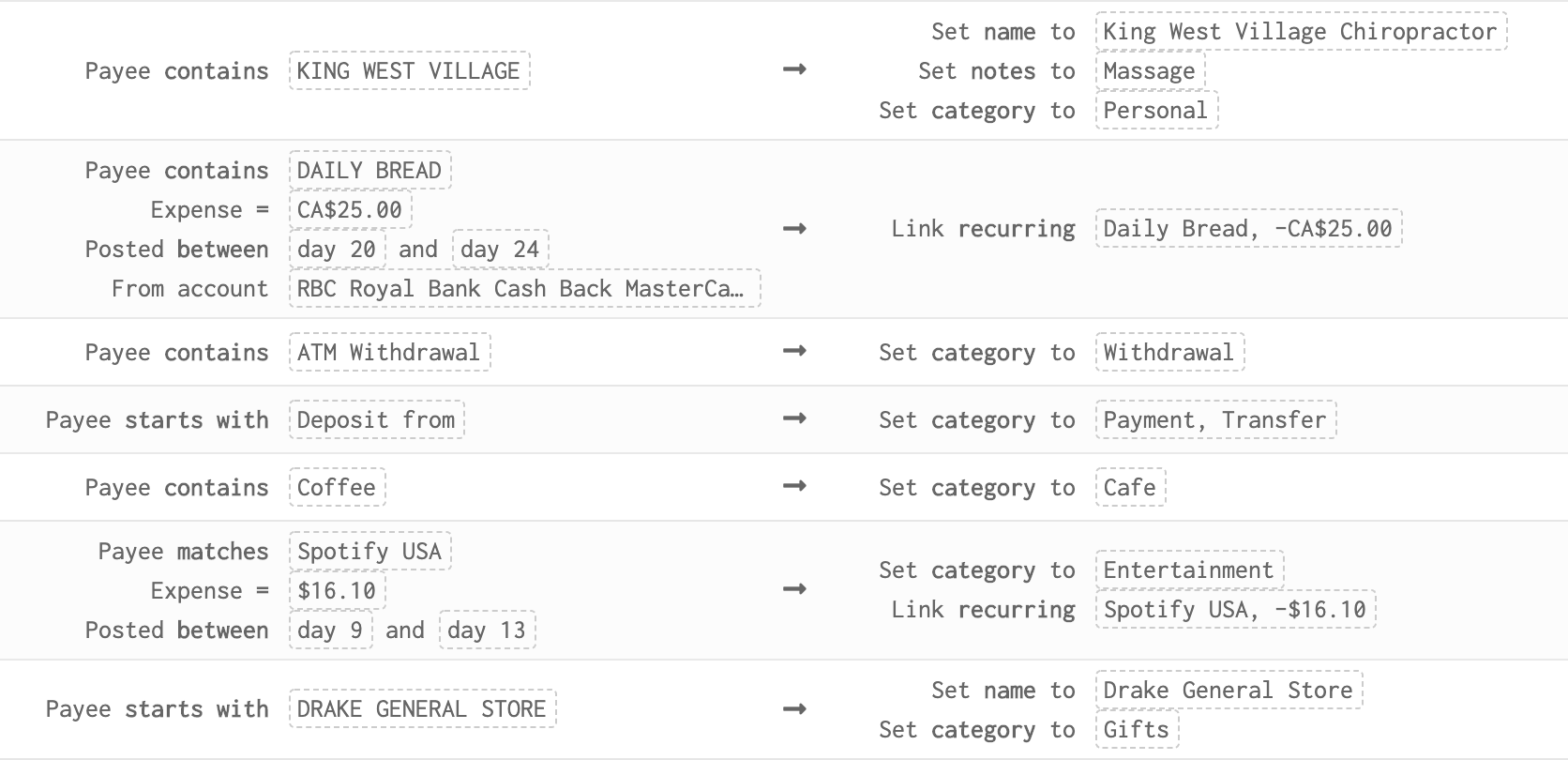

Ask you to do it: Some apps just ask you to put each transaction into a category. Sometimes this is supplemented with rules (Monarch, for example, has a very slick and easy to use rule engine).

Both: The best apps out there do a combination of both, where the initial category is set by guessing and you can change it if the guess is incorrect.

Note that most category lists out there include hundreds of individual categories that are often nested within one another. Here’s what the category rules engine from Lunch Money looks like. Does this look easy to manage?

Why Categorize?

For the organized types, of which most money nerds are, categorizing just feels good. Just like cleaning your home, it feels great to know every dollar has a nice little bucket to which it’s assigned.

Plus, once every transaction is properly categorized, you can start to answer questions like:

“How much did I spend in a category?”When most people think of budgeting, they think this is the most important question. For example, how much did one spend on transportation vs. dining out.

“Am I spending more in a category now vs. in the past?”

“Could I save more money by spending less in a particular category?”

These might seem like important questions to answer if you want to get ahead financially but we think there’s a better way. Could you get the same feel good feeling without the work?

Why Categorizing Doesn’t Work

Based on our research building Spend, we’ve found that people generally have a good internal compass, when it comes to their spending and savings. In other words, if you’re trying to save up for something, you naturally spend less. Similarly, if you know you’re savings are on track, and you have free cash, you spend more freely.

Knowing how much you spend on a single category doesn’t change your behavior. In fact, we’ve found that people find it somewhat petty and punitive. Think about it, if someone told you that, in the last month, you spend $100 on coffee or $400 on ride-sharing transportation, how would that change your behavior? Those expenses are part of your lifestyle. What we’ve seen is that when people notice how much their spending in a particular area, they don’t reduce spending in that category, they reduce spending across the board.

When people notice how much their spending in a particular area, they don’t reduce spending in that category, they reduce spending across the board.

Think about it. A social night out could consist of a ride to a venue, drinks, another ride, dinner, and maybe tickets to a show, then another ride out. Each of those transactions would be a different category (e.g., transportation, bars, restaurants, entertainment). But they’re really just part of a much bigger category: discretionary expenses. They collective become part of the cost of your lifestyle.

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.” —Ramit Sethi

We believe that while it’s extremely important to know how much your lifestyle costs, it’s not as important to know why.

The important question is: “if you make X and you spend Y, is Y > X.”

A Better Way: Discretionary Allowance

At Spend, we follow a simple formula:

Recurring income - recurring expenses = discretionary allowance

We connect to your income and spending accounts and you only have to categorize a few transactions into one of two buckets:

Recurring income: your paycheck or salary

Recurring expenses: regular monthly expenses that don’t change much month-to-month (e.g., rent, phone bill, subscriptions, gym memberships, child care, etc.)

Once you do that once, Spend can automatically spot and make an educated guess the next time we see a transaction like that. But unlike other apps, our educated guesses are extremely accurate because we know a lot about what your recurring income and expenses look like and they don’t change much month-to-month.

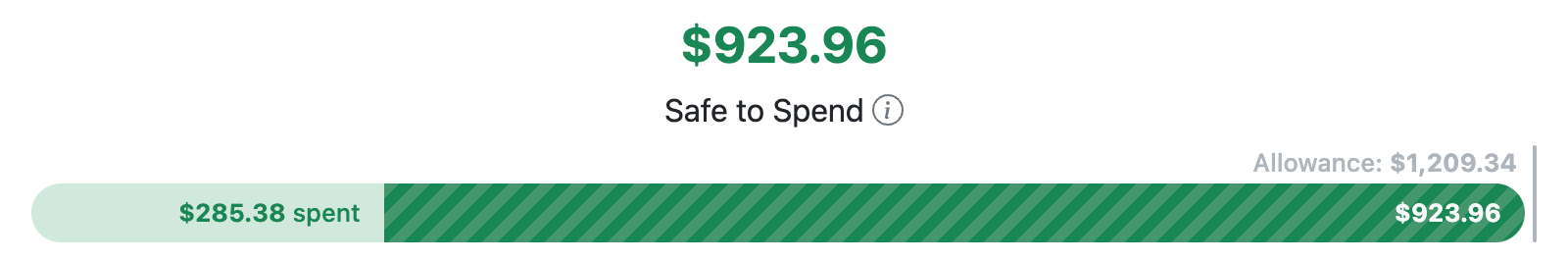

From there, we just subtract recurring income from recurring expenses to determine:

- Discretionary allowance: how much you can safely spend before you risk dipping into your savings or potentially running out of money to cover your regular bills

We believe that your discretionary allowance (what we call your “Safe to Spend”) is the only number that really matters. Spend it on whatever you’d like! Just know what the limit is and whether you’re over or under.

One-off Expenses and Annual Bills

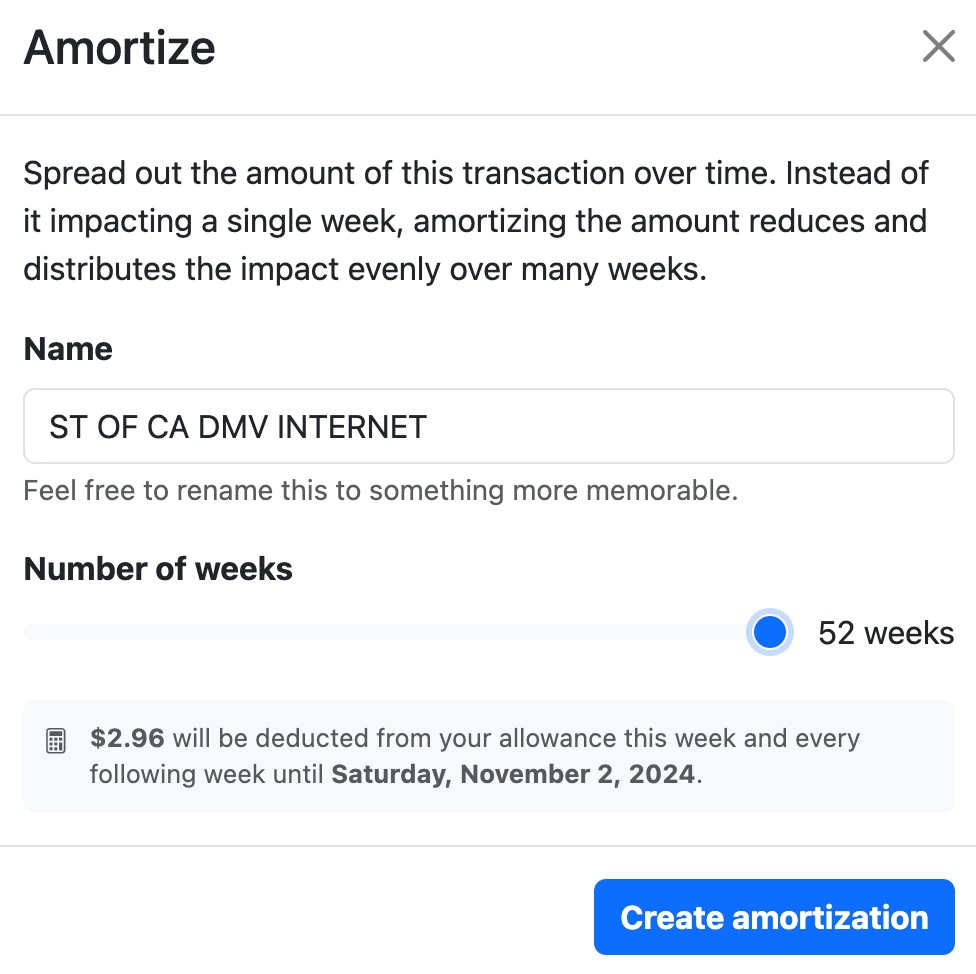

Spend starts by looking at your monthly income and expenses. But that’s not the whole picture. If you’ve got a big property tax bill or annual car registration, for example, you still might find yourself falling short and might have to dip into your savings to cover.

To solve this, Spend allows you to amortize any transaction. In the example below, you can see this in action with a DMV registration renewal that’s being spread out over 52 weeks. Loper automatically curtails your weekly and monthly Safe to Spend so you’re not caught out by this expense the next time it happens.

This works equally well for large one-off expenses. For example, if your favorite band just announced it’s coming to town to play a show and you jump to buy tickets before they sell-out, you can amortize the cost of those tickets over as many weeks as you’d like so you don’t have to dip into your savings.

Stop Categorizing & Save Time

We find that, on average, people spend 1-2 hours categorizing transactions or managing the rules that categorize their transactions. And, unfortunately, unless you spend money on exactly the same things every month, which no one does, it never gets easier. Sure, some apps make it easier than others, but it still takes time.

There is one side-benefit to categorizing transactions, which is that your eyes review every transaction and that’s invaluable. Spend makes this a breeze.

Review Transactions with Ease

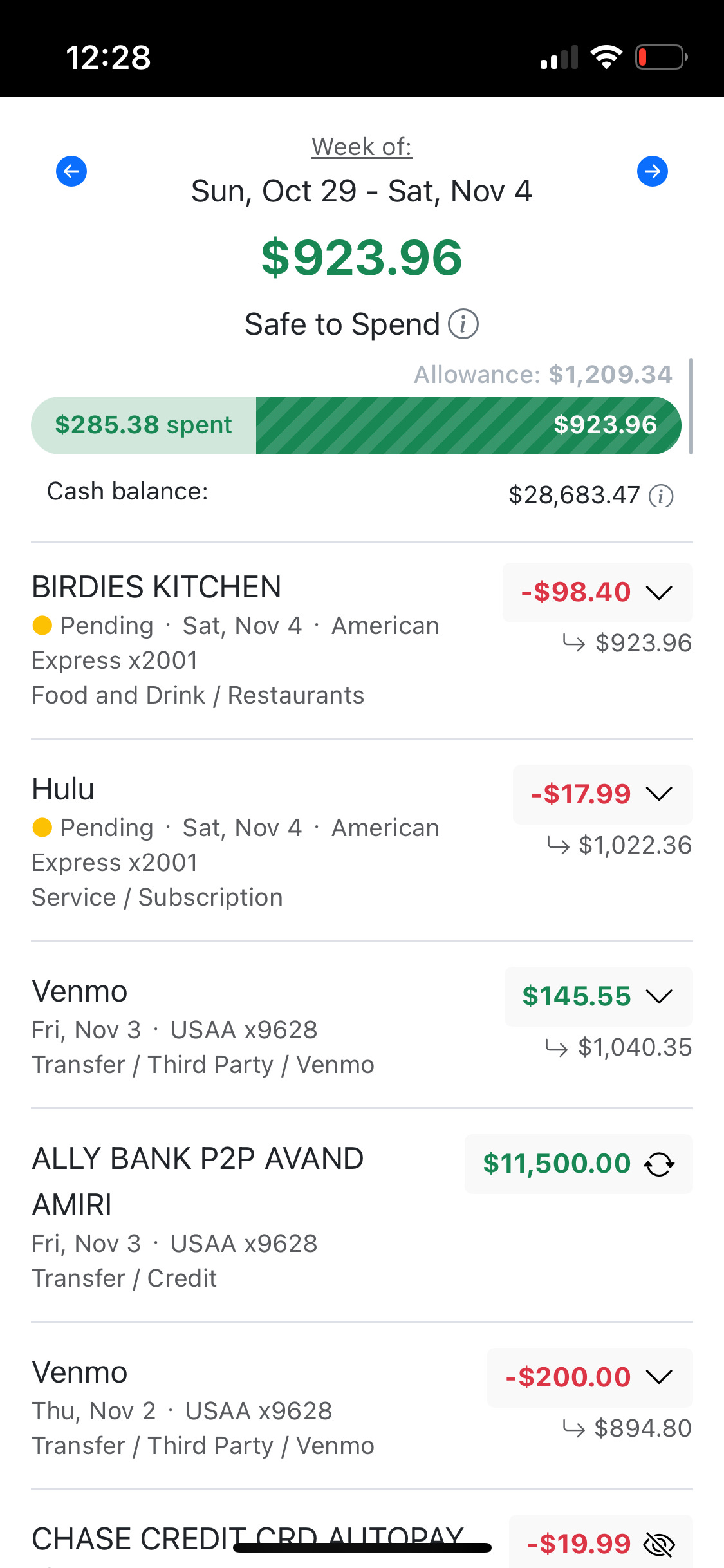

Spend neatly lists transactions from all your accounts. Transactions are grouped by week or by month and designed to be easy to scan with a simple scroll.

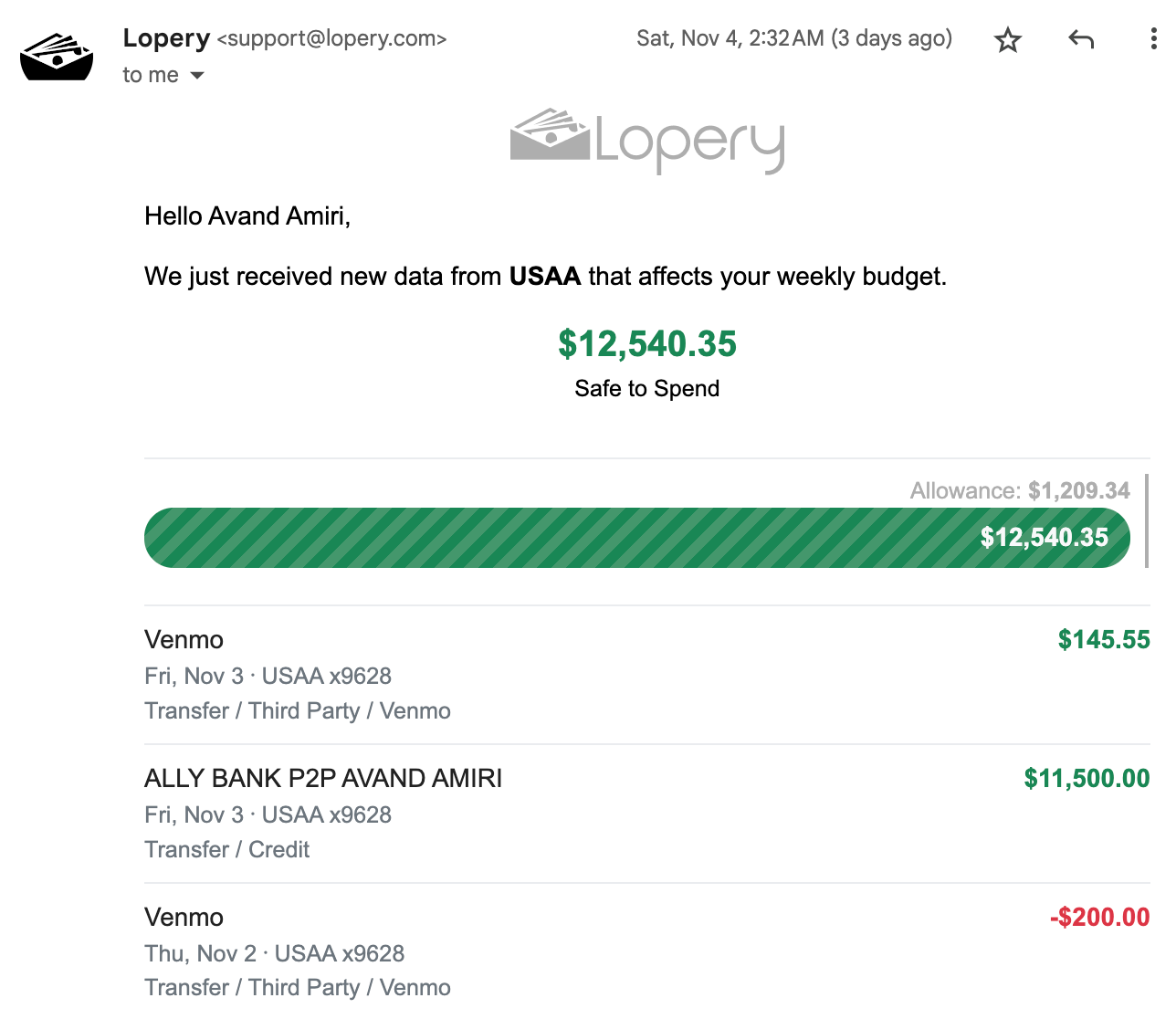

Review Transactions from Your Inbox:

Whenever new transactions come in, we send you a summary via email. Customers love this because they don’t have to do anything they aren’t already doing: checking their email. If something looks off, more information is just a tap away.

What used to be 1-2 hours each month can turn into a passive 3-5 minutes. At Spend, we believe you end up getting the same value but for a lot less time. Time you can spend doing other things like enjoying your life or making more money!

Ready to save your time and give Spend a try? We think you’ll find it liberating and appreciate any feedback in the comments.